|

Picture this: You’re at the store, picking up essentials, and you notice that products marketed towards women cost more than those for men, even though they serve the same purpose. This isn’t just a coincidence—it’s a phenomenon known as the “Pink Tax.” While it’s not a literal tax, the Pink Tax represents the extra cost women often pay for products and services that are nearly identical to those offered to men.

The Origins and Impact of the Pink Tax 🚨

The term "Pink Tax" first gained significant attention in 2016 when New York’s Department of Consumer Affairs conducted a study revealing that women were consistently paying more for certain products compared to men. However, the issue had been recognized much earlier, with research into this pricing discrepancy dating back to the 1990s and beyond.

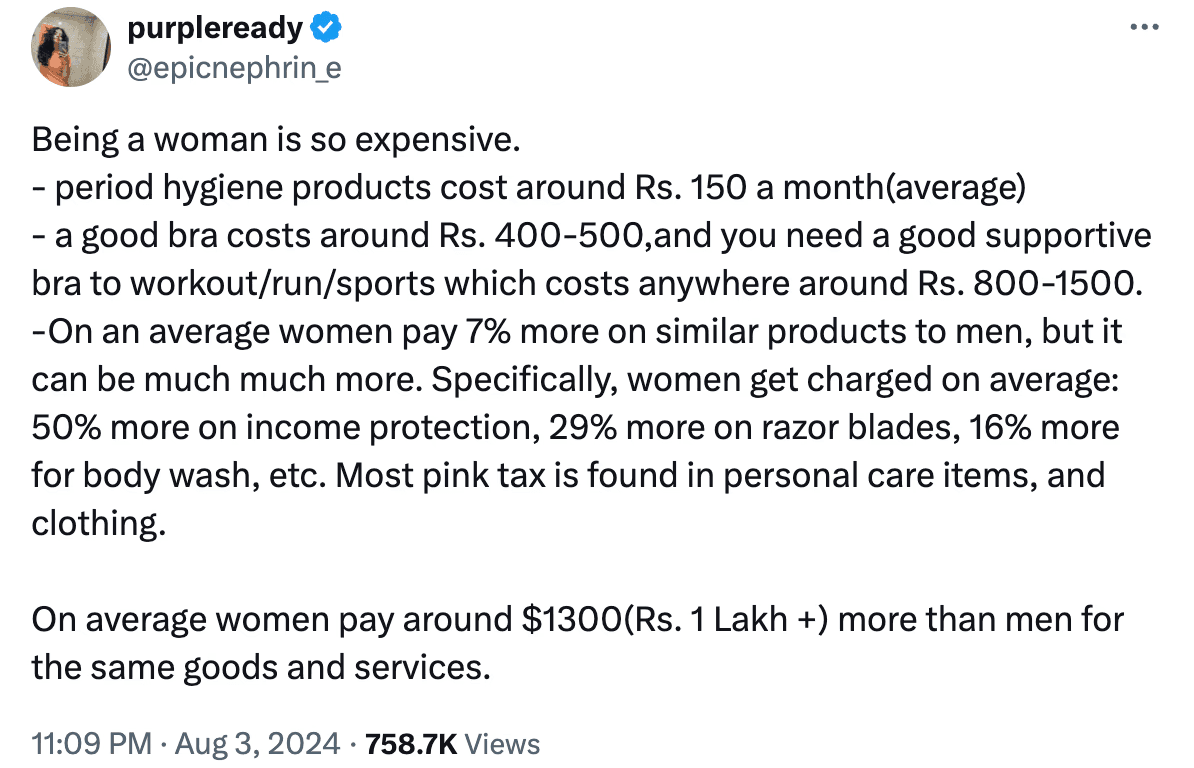

In essence, the Pink Tax is a form of gender-based price discrimination. Products like razors, shampoos, deodorants, and even toys and clothing often come with a higher price tag simply because they are marketed towards women. This unfair practice extends beyond consumer goods to services as well, such as dry cleaning and haircuts, where women frequently pay more than men for similar services.

The Pink Tax in India: A Double Burden 🇮🇳

In India, the Pink Tax is particularly problematic given the existing gender pay gap. Women in India earn, on average, 19% less than their male counterparts, according to various reports. Despite earning less, women are often required to pay more for similar products and services, effectively penalizing them twice—once in their earnings and again in their expenditures.

For instance, a basic razor for men might cost ₹10, but a similar razor marketed towards women could be priced at ₹50. This discrepancy isn’t just limited to personal care items. A 2018 report highlighted that even necessary products like menstrual sanitary items were initially placed under a 12% GST slab, only to be removed after significant public outcry and campaigning.

In India, this trend is evident across various sectors. For example, health insurance premiums for women are often higher, and products like women’s apparel and grooming items are priced significantly higher than men’s equivalents. The World Economic Forum also found that women’s old-age care products are 8% more expensive compared to those for men.

Why Does the Pink Tax Exist? The Underlying Causes 🔍

The existence of the Pink Tax can be attributed to several factors. One major reason is the way products are marketed. Companies often create gender-specific packaging that appeals to societal norms about femininity, which can justify higher prices in the eyes of consumers. The so-called "pink and shrink" phenomenon involves making products smaller, pink-colored, or more “feminine” in appearance, thereby justifying a higher price tag.

Another contributing factor is societal expectations. Women are often subjected to higher standards of grooming and appearance, which drives them to purchase more expensive products to meet these societal norms. This societal pressure translates into a willingness to pay more for certain products, which companies exploit through higher pricing.

How to Avoid Falling into the Pink Tax Trap 🚫

While the Pink Tax is pervasive, there are ways to avoid it. One effective strategy is to opt for unisex or gender-neutral products, especially when the difference between male and female versions is negligible. For example, instead of buying a razor marketed towards women, one could choose a men’s razor, which often performs just as well but costs less.

Supporting brands that actively stand against the Pink Tax is another way to combat this issue. Some companies have taken a stand by either reducing the price disparity or offering gender-neutral pricing for their products. Consumers can also make informed choices by researching and comparing prices before making purchases.

The Broader Implications: Beyond Just Shopping 🌐

The Pink Tax is not just about spending a few extra rupees; it reflects broader societal issues of gender inequality. Over a lifetime, the cumulative effect of the Pink Tax means that women are spending significantly more than men for the same goods and services, exacerbating economic disparities between genders.

Addressing the Pink Tax requires both awareness and action. As consumers, we can demand more equitable pricing and support brands that practice fair pricing. At a societal level, there needs to be a greater push towards recognizing and addressing these subtle yet pervasive forms of gender discrimination.

Let’s Take a Stand Against the Pink Tax! 💪🏼🛒

By making conscious choices and raising awareness, we can work towards a marketplace that is fair for everyone, regardless of gender.

Everything you need to know about Sukanya Samriddhi Yojana

Nov 13, 2024

Financial Resilience: Lessons from the Women of House of the Dragon

Sep 2, 2024

5 Things You Should Know Before Taking a Loan 👩💼💸

Aug 21, 2024

The Pink Tax: Why Women Pay More for the Same Products 💸👩

Aug 14, 2024

Budget 2024: A Win or a Loss for Women? 🎉💼

Jul 25, 2024

Unlocking your go to guide to navigate Gold 🌟

Aug 28, 2023