|

Out of the 30 million women borrowers in India, about 18 percent are taking loans to buy consumer durables, 12 percent are opting for credit cards and only 3 per cent are opting for home loans. So while women are not hesitating to take loans for consumer durables or get credit cards, we are hesitating to take loans to buy homes or to fund an education.

Instead of avoiding loans, you can build assets by thoughtfully taking loans that you can afford to repay and add value to your life over time. One major advantage of most loans is the tax benefits you can get while repaying them.

Let’s learn more about the tax benefits of loans taken for various purposes.

Loan for a constructed house:

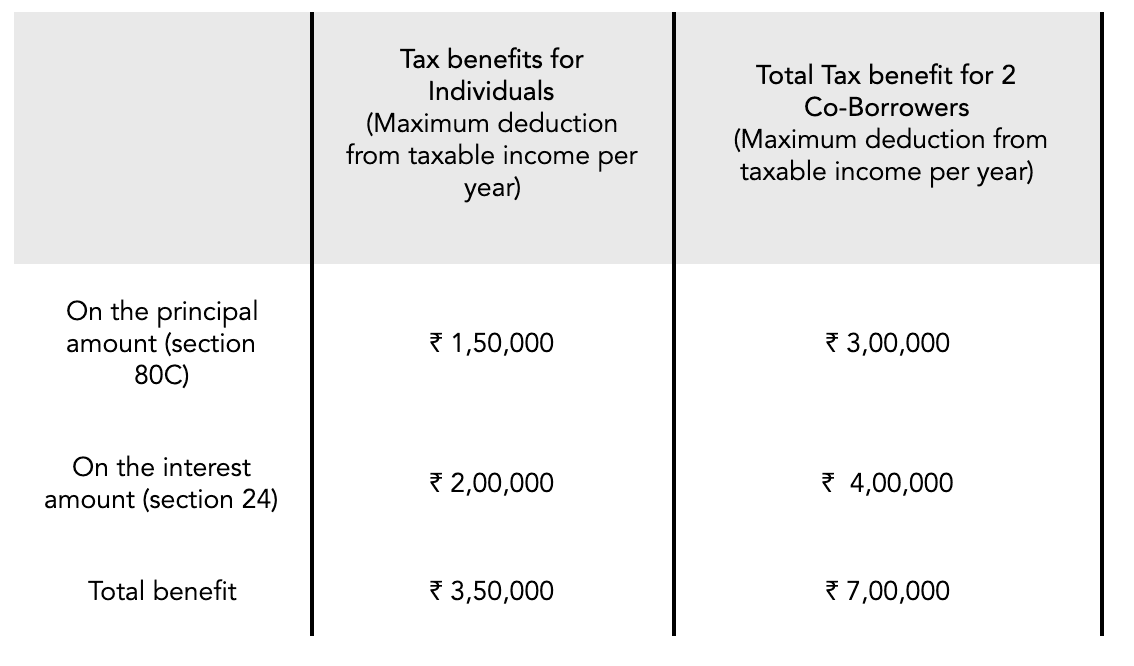

While repaying a home loan, you can get a tax benefit on the principal as well as interest component. You can also include the registration charges and stamp duty in the principal amount.

If you are a woman with a regular income and wish to purchase your own house, you can greatly benefit from co-borrowing with your family member/spouse. When you have a co-borrower, you have higher loan eligibility and both borrowers can get a tax benefit. Keep in mind to choose a co-borrower who has a steady income and good credit history

Suppose your income is ₹ 12,00,000, you get a total tax exemption as an individual of ₹ 3,50,000 and brings down your taxable income to ₹ 8,50,000.

It is important to remember that unless you are a co-owner of the house, you cannot claim tax benefit as a co-borrower. So make sure you are listed as an owner on all the paperwork! In addition, the tax benefit enjoyed by each co-borrower is in proportion to their contribution to the repayment of principal and interest. As illustrated above, this will be applicable to two individuals.

Loan for an under-construction house:

If you have taken a loan for a house that is still under construction, you can claim a tax deduction on the interest component of your loan. This deduction can be claimed in five equal instalments over a period of five consecutive years starting from the year you take possession of the house.

If you sell your house within 5 years of getting possession, you will not get any tax benefit in the year of sale and also, the deductions that you have claimed in the past will be treated as your income in the year of sale. Thus, in that year, your taxable income will be considerably higher.

Loan for a second home:

If you own more than one house, you can get the tax benefit for housing loans of every house. However, the maximum deduction that you can get in a year remains the same. Therefore, if you are already utilizing the limits for tax deductions with one loan, you will not get further tax benefits on the other loan(s).

Personal loan

The principal and interest on a personal loan are not eligible for tax deductions. However, the interest payable on the loan is eligible for a tax deduction if the personal loan is taken for

Purchase of assets such as shares, gold etc

Home renovation

Down payment of a home Investment in your business

Education loan

You can avail tax deduction on the interest component of a higher education loan, for a maximum of 8 years or the loan repayment term, whichever is shorter. Important things to remember while taking an education loan.

To be eligible for tax benefits you should have taken the loan from a bank or non-banking financial company and not a private lender or relative.

You can claim tax benefits for an education loan taken for yourself, your spouse, your children or someone who you are the legal guardian of.

Bottom Line

With a steady and higher disposable income, you can achieve your goals of a dream home, higher education or investing in your business by taking a loan. Not only will you own an asset but also avail tax benefits by repaying the loan.

This article is written by Namrata Patel for Basis.

Basis is a first-of-its-kind platform, aimed at enabling women to achieve financial independence through expert advice, in-app knowledge Boosters and supportive communities.

Everything you need to know about Sukanya Samriddhi Yojana

Nov 13, 2024

Financial Resilience: Lessons from the Women of House of the Dragon

Sep 2, 2024

5 Things You Should Know Before Taking a Loan 👩💼💸

Aug 21, 2024

The Pink Tax: Why Women Pay More for the Same Products 💸👩

Aug 14, 2024

Budget 2024: A Win or a Loss for Women? 🎉💼

Jul 25, 2024

Unlocking your go to guide to navigate Gold 🌟

Aug 28, 2023