|

Freelancing? You go, girl! That’s awesome. But that doesn’t mean you’re exempt from paying taxes. While you might love not being under the 9-5 clock anymore, your taxes also require a certain amount of love and care.

Unlike regular salaried individuals, you do not fall under one employer who deducts your TDS or provides you with a Form16. This is where you’ll have to do a little groundwork.

But before we begin, we’ll first understand what constitutes freelance income.

Freelance income is all the income you have received from various projects and gigs that you have taken up through the course of the year. This could be income from blogging, digital marketing services, social media management, consulting, web developing, designing, rendering your services as a photographer, vlogging and many more.

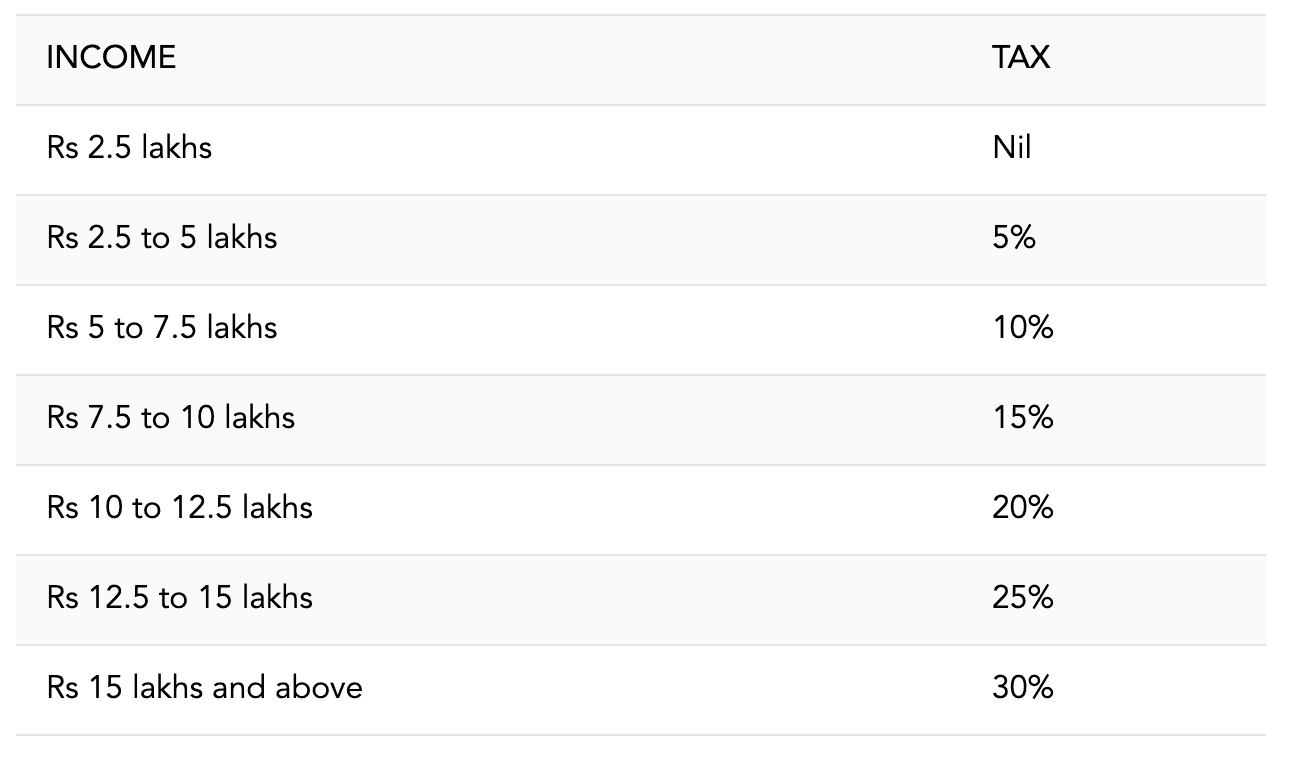

This sounds cool? Now let’s see if the income tax slabs are exactly the same for freelancers too.

The answer is YES! Exactly the same.

*This table is applicable for FY 2019-2020

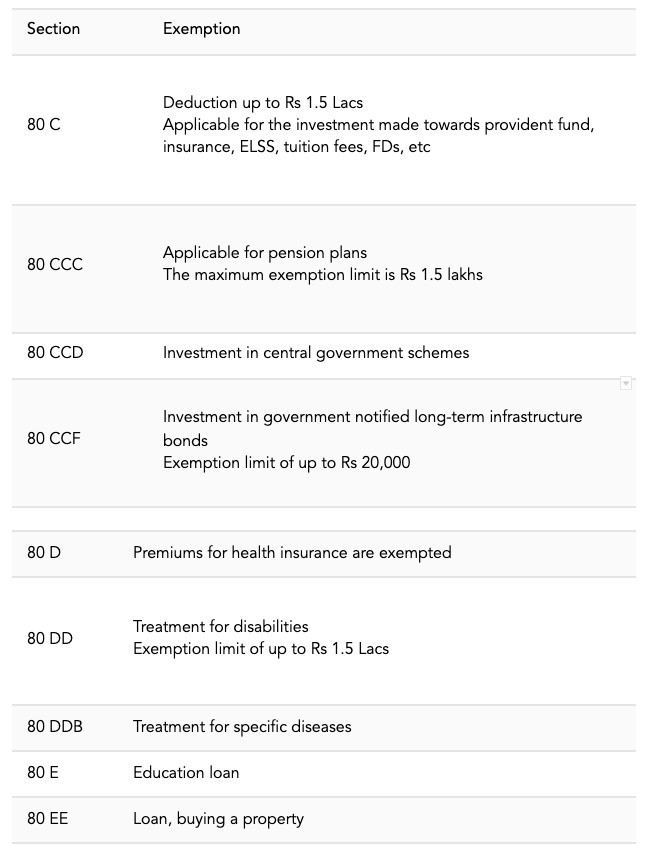

According to Section 80 of the Income Tax Act, you as a freelancer can cut down your taxable income by more than Rs 1.5 lakh if you invest a specific amount in tax-saving instruments.

Tax Exemptions under Section 80

What about expense deductions?

We thought you’d never ask!

Before understanding the term ‘expenses’, here are some of the essential conditions that you should ensure that you follow.

Your expenses must be directly proportional to the amount spent while carrying out a specific task, must belong in the relevant financial year and must not include personal or capital expenditure.

These expenses fall under travel to the client location, hospitality, office supplies, property rent, entertainment, meals, etc.

These expenses can be deducted from your gross taxable income to reduce your tax outgo. The Income Tax Act allows you to do this because these expenses are incurred for the purpose of acquiring and delivering your work.

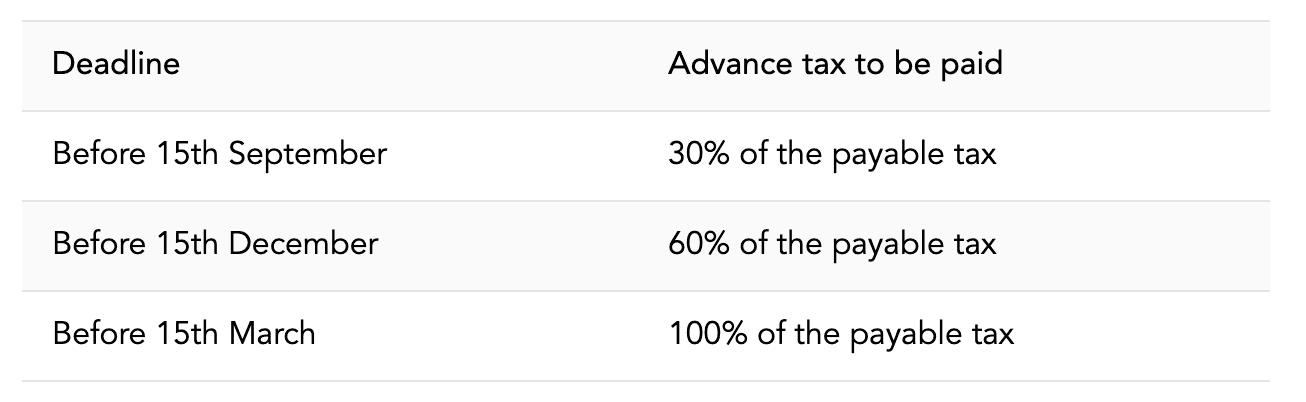

Now, let’s talk about Advance tax! Confused and don’t know how to calculate it?

Before you pay your advance tax, here’s a simple rule you can follow.

- Collect all your invoices and receipts and calculate your total income

- Calculate your expenses as against your incomes.

- Do not forget to include income from other sources like savings accounts and properties (Nah ah! Can’t-miss those)

- Calculate your tax after based on your tax slab.

And what form do I use?

Oops! That’s the most important one!

ITR-4 is the one for you!

If your tax liability does not exceed more than Rs.10,000 for a financial year, you need not pay taxes. However, if you fail to pay advance tax, then you are liable to pay interest on the tax. Hefty bucks are what we’re talking about.

Everything you need to know about Sukanya Samriddhi Yojana

Nov 13, 2024

Financial Resilience: Lessons from the Women of House of the Dragon

Sep 2, 2024

5 Things You Should Know Before Taking a Loan 👩💼💸

Aug 21, 2024

The Pink Tax: Why Women Pay More for the Same Products 💸👩

Aug 14, 2024

Budget 2024: A Win or a Loss for Women? 🎉💼

Jul 25, 2024

Unlocking your go to guide to navigate Gold 🌟

Aug 28, 2023