|

The end of the financial year, amongst other things, brings tax-planning into everyone’s must-do list. It was no different for my dear friend Aarti, a 40-year-old woman, who works full-time with a corporation.

“Thank God due to tax-planning, at least I am forced to make some investments'', said Aarti, as we talked about her tax-planning choices. Like many others, Aarti considered tax-planning as one of her primary reasons for making investments.

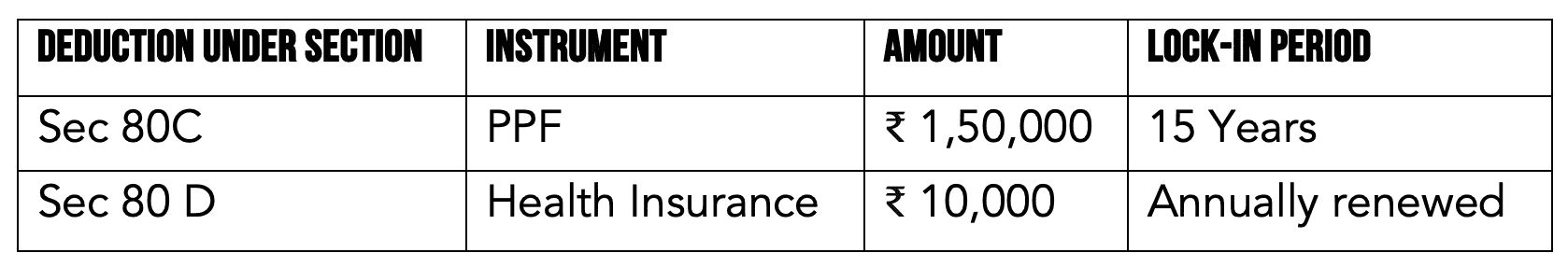

She shared with me her plan for 2019, which looked like this:

While what she was doing seemed reasonably sound, the only question which caused her discomfort was me asking her, “Are these linked to your long-term goal of retirement savings?”.

While Aarti earned handsomely, she had never taken out the time to create and jot down her short, medium and long-term financial goals. She has made haphazard investments, advised by friends, family or even bank managers, which were not in line with her financial goals.

Why are financial goals important in tax-planning?

Since most tax-saving instruments have a minimum lock-in period, they are designed for long-term goals such as child’s education, retirement planning, and so on. Hence, having clear long-term goals is required in choosing the most suitable investment mix.

Creating a goal comprises a defined amount and a set period.

An example of a long-term goal for Aarti could be building a retirement corpus of approximately ₹ 1 Crore by the age of 60, i.e. 20 years later. On the Basis App, you can define the exact amount required, based on current and expected lifestyle.

What other factors impact tax-planning?

After defining her goal, Aarti would have a definite desired amount and investment time horizon. Apart from these two factors, she also needs to consider her risk appetite and the expected rate of return from her tax-saving instruments.

Expected rate of return helps her identify which investment/s to choose, while risk appetite will define the weightage to be given among the selected investments.

Reaching the long-term goal

Once she can identify the above factors, it is merely a matter of deciding which instrument is suitable for her and how much amount should be invested.

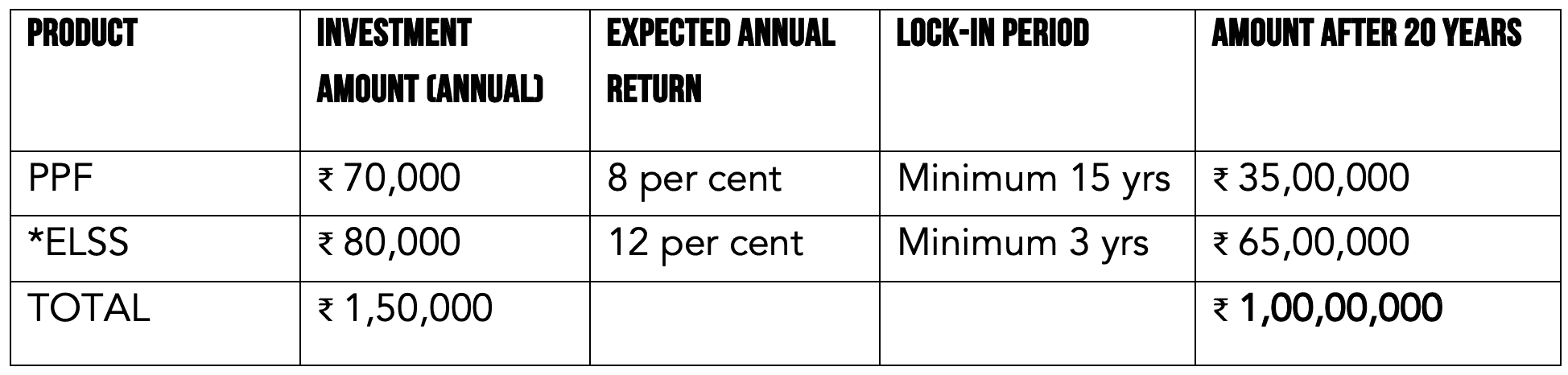

If Aarti were to continue investing ₹ 1.5 Lakhs per annum in PPF, after 20 years, she would have a corpus of approx. ₹ 70 Lakhs. While this would be a low risk, she would be ₹30 Lakhs short of her retirement goal.

On the other hand, if Aarti opts for a slightly higher risk- high return product such as the Equity Linked Saving Scheme Mutual Funds, she would be much closer to her retirement goal. The below combination of tax-saving investments every year for the next 20 years would land her, perfectly prepared for her goal :

*ELSS: Equity-linked savings schemes

Bringing clarity of goals would help Aarti in clearly identifying suitable tax-saving instruments and investment horizons. Without this discipline and clarity, her tax-saving plan would remain ad-hoc and not necessarily make her hard-earned money benefit her in the long-term.

Various tax-saving investment options could help other specific goals, such as:

Sukanya Samrudhi Yojana - Investing for your daughter

Term Insurance - A pure risk protection that will help you insulate your family from the financial loss incurred, in the eventuality of the sudden death.

Employee Provident Fund - will serve your retirement and more.

A combination of the right tax-saving investments should be your priority. As always, the golden rule is to make investments that align with your life goals. At Basis we recommend you get a head start and plan for the next financial year, starting April.

Everything you need to know about Sukanya Samriddhi Yojana

Nov 13, 2024

Financial Resilience: Lessons from the Women of House of the Dragon

Sep 2, 2024

5 Things You Should Know Before Taking a Loan 👩💼💸

Aug 21, 2024

The Pink Tax: Why Women Pay More for the Same Products 💸👩

Aug 14, 2024

Budget 2024: A Win or a Loss for Women? 🎉💼

Jul 25, 2024

Unlocking your go to guide to navigate Gold 🌟

Aug 28, 2023